Enes Evren

In February 2023, when I published my last article about Simon Property Group (NYSE:SPG), I gave the stock a “Buy” rating, but I was torn between optimism and pessimism resulting in the title” Reasons for Caution and Confidence”.

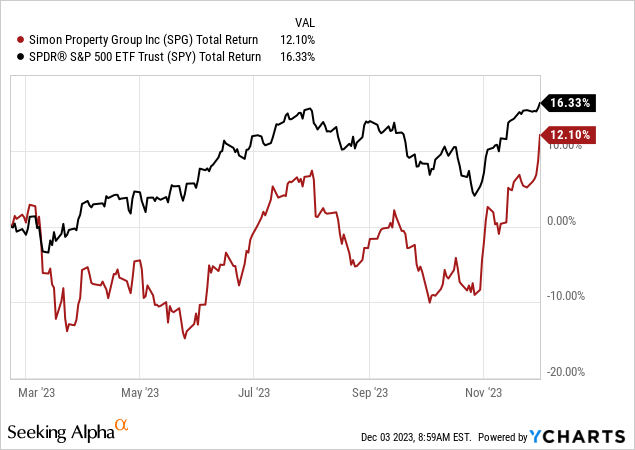

Now, the stock is trading more or less for the same price as when my last article was published. Simon Property returned about 11% in the meantime, but that was mostly due to dividends. And when comparing the performance of Simon Property Group to the S&P 500 (SPY), the stock still underperformed. But the overall picture remains the same – Simon Property Group is still presenting several reasons to be optimistic, but we also have reasons to be cautious. We start by looking at the quarterly results, which is rather a reason to be optimistic.

Quarterly Results

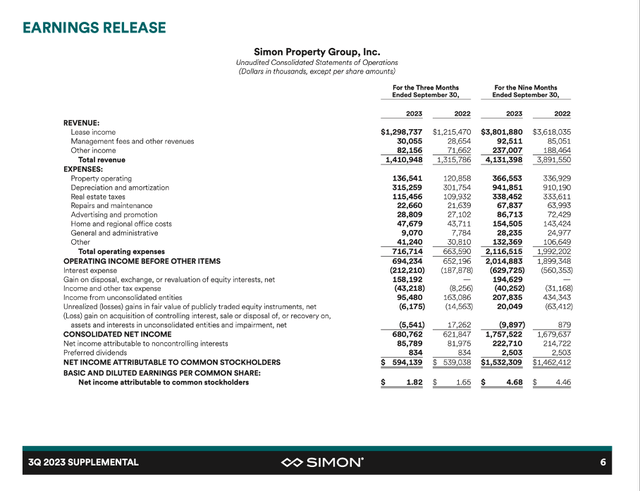

In the third quarter of fiscal 2023, Simon Property Group generated $1,411 million in revenue and compared to $1,316 million in revenue in Q3/22 this is an increase of 7.2% year-over-year. The biggest part of revenue ($1,299 million) is stemming from “lease income” and about $30 million are stemming from “management fees and other revenue” while $82 million are “Other income”. Operating income also increased 6.4% year-over-year from $652 million in the same quarter last year to $694 million this quarter. And finally, diluted earnings per share increased from $1.65 in Q3/22 to $1.82 in Q3/23 – resulting in 10.3% YoY growth.

Simon Property Group Q3/23 Supplemental Information

And finally, funds from operations – probably the most important metric for Simon Property Group – increased from $2.93 per share in Q3/22 to $3.20 per share in Q3/23 – 9.2% year-over-year growth.

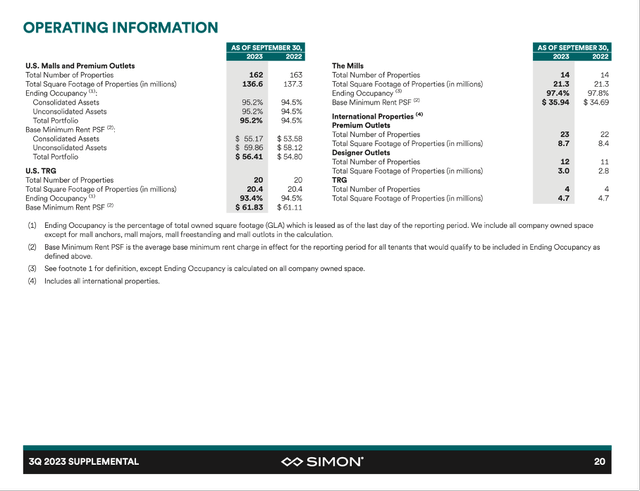

Further important metrics for Simon Property Group are the occupancy rate as well as the minimum rent per square foot. And for its “U.S. Malls and Premium Outlets” (with 163 properties the biggest part of its portfolio) the occupancy rates increased slightly from 94.5% one year earlier to 95.2% and the base minimum rent per square foot also increased from $54.80 to $56.81. When looking at “The Mills” the occupancy rate declined slightly from 97.8% to 97.4% and the base minimum rent per share foot increased from $34.69 to $35.94.

Simon Property Group Q3/23 Supplemental Information

U.S. TRG (the joint venture between Simon Property Group and Taubman) also saw its occupancy rate decline from 94.5% one year earlier to 94.4% at the end of this quarter. Base minimum rent per square foot however increased slightly from $61.11 to $61.83.

Simon Property Group Q3/23 Supplemental Information

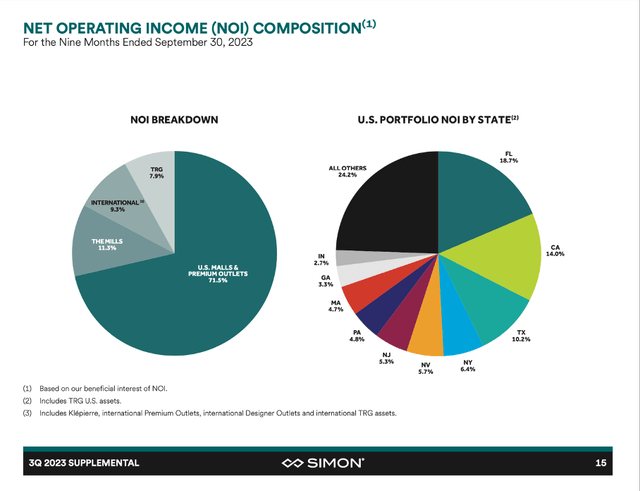

But in the end, it is especially the U.S. Malls that are important as they are responsible for 72% of net operating income.

Solid Growth

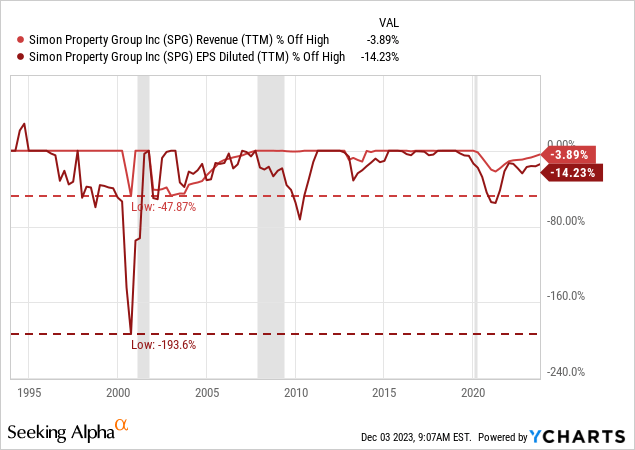

Growth for Simon Property Group clearly slowed down in the last few years. When looking at the 10-year CAGR, operating income increased only 1.55% annually on average and earnings per share increased with a CAGR of 3.28% in the last ten years. This is far away from the high single digit or even double-digit growth rates Simon Property Group reported in previous years.

When asking about the 3% organic growth target during the earnings call, David Simon was optimistic that SPG can achieve that growth level next year. And management was also optimistic to keep its occupancy rate at a high level and being able to raise rents in the years to come – two aspects that will contribute to revenue growth:

I think we'll be, year-end occupancy will be obviously higher than it is today. I don't know that it will be our highest ever, but it it'll be within distance pretty close. Even with all the volatility in the world and the market, we still expect -- we still see demand very strong. I mean, we're -- frankly, we're cautious, we're waiting for shoes to drop, but we haven't seen it on our new deals, whether it's F&B, entertainment, high-end luxury tenants, athleisure, just to name some categories. We're seeing -- we're still seeing a lot of demand on that front. And I would say from a pricing element, we feel -- I would say we feel comparable to the way we felt in ‘15, ‘16, ‘17 era, in terms of era. I guess that was almost seven, eight years ago, but lots happened over those seven or eight years.

Management is probably optimistic about a high occupancy rate in the years to come as it is seeing positive leasing momentum across the portfolio. During the last earnings call, management also stated:

Leasing momentum continues across our portfolio. We signed more than 970 leases for approximately $4.3 million square feet in the quarter. Through the first nine months of 2023, we signed more than 3,500 leases for 15 million square feet, which is expected to generate over $1 billion of revenue. We have an additional 1,100 deals in our pipeline, including renewals for another $400 million in revenue. We are seeing strong broad-based demand from retail community, including continued strength for many categories.

And Simon Property Group is continuing to construct new outlets. During the last quarter, construction on its Jakarta Premium Outlet – the first in Indonesia with about 300,000 square foot – started and it is expected to open in February 2025 (SPG has a 50% ownership). Aside from the construction of new outlets, redevelopment and expansion projects at properties in North America and Asia also continue.

Finally, Simon Property Group also increased (or had to increase) its ownership in Taubman. Management explained during the earnings call:

During the third quarter, the Taubman family exercised their put right on a portion of their interest in TRG. We exchange 1.725 million partnership interest units for an additional 4% ownership interest. We now own 84% of TRG. Domestic property NOI increased 4.2% year-over-year for the quarter and 3.8% for the first nine months.

Dividend

Another positive news for Simon Property Group is the constantly increasing dividend. After the company suspended the dividend in 2020 for one quarter, it has increased the quarterly dividend eight times. Of course, these were only increases in the low single digits, but overall, the dividend was increased 46% from $1.30 in early 2020 to $1.90 per quarter right now. Nevertheless, we must point out that Simon Property Group’s dividend is still below the pre-COVID level of $2.10 per quarter.

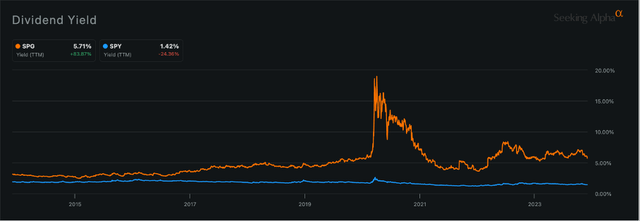

Simon Property Group vs. S&P 500 dividend yield (Seeking Alpha)

Of course, Simon Property Group is interesting for its dividend and with an annual dividend of $7.60 the company has a dividend yield of 6.3%. And when comparing that amount to $12.23 in funds from operations per share in the last four quarters, we get a payout ratio of 62%, which is sustainable and acceptable.

Problems Remaining

While the reported results, the constantly increasing dividend and the statements made by management during the earnings call are positive, I see dark clouds on the horizon and the reason to be cautious I mentioned in my last article still exist. For Simon Property Group, two aspects could especially become problematic – a lower occupancy rate and lower rent per square foot. A lower occupancy rate could be the result of tenants going bankrupt and a lower rent per square could be the result of weak demand from customers leading to retailers closing stores or being more hesitant to open new ones. This will soften the demand for retail space and have a negative impact on prices.

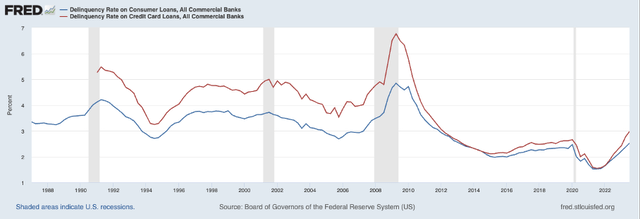

In my last article about Simon Property Group, I already talked about credit card delinquency rates. In February, despite already rising delinquency rates, it was rather low and not problematic yet. Now, about three quarters later, the picture is changing.

Delinquency rates for all consumer loans are constantly increasing since early-mid 2021, but especially the delinquency rate for credit cards is increasing with a high pace and with a rate of 2.98% in Q3/23 in the United States, we have the highest delinquency rate since Q1/12. And although we are nowhere close to delinquency rates we saw in the past (especially not during the Great Recession), this is a worrisome trend.

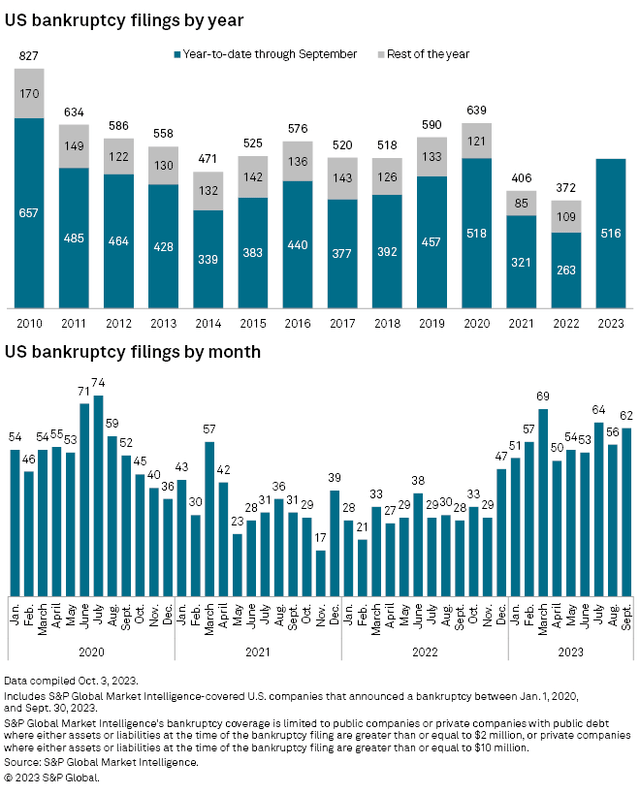

Additionally, we can also look at bankruptcies – which have also the potential to threaten Simon Property Group – and the trends we are seeing are also worrisome. When looking at the reported numbers for January till September, the United States saw 516 bankruptcies so far in 2023. Aside from 2020 (a year with a recession) with 518 bankruptcies in the same timeframe, this is the highest amount since 2010.

Bankruptcy Filing since 2010 (S&P Global)

When looking at the number of bankruptcies in the last few months, the number not accelerated but the picture is not looking great.

And in an article published in June 2022, I already pointed out that Simon Property Group is usually reacting to a recession, and we see earnings per share as well as revenue decline in such an economic environment.

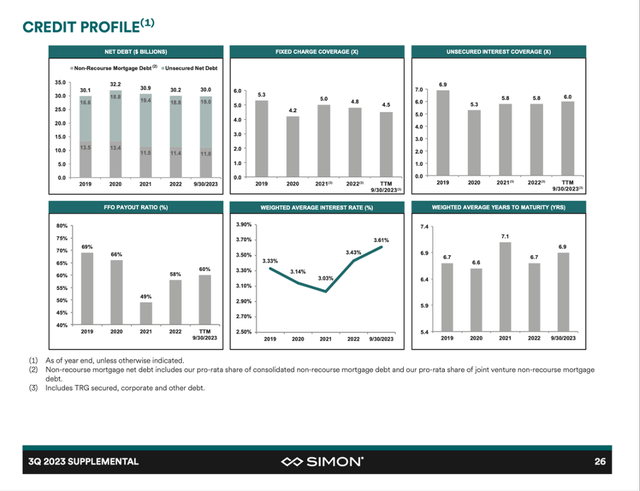

A problem for Simon Property Group could also be the rather high debt levels the company has to pay – and while the credit profile is getting worse, we don’t really know how interest rates will develop (I expect we see lower rates again in the coming quarters, but we don’t know).

Simon Property Group Q3/23 Supplemental Information

Intrinsic Value Calculation

Finally, let’s calculate an intrinsic value for the stock to determine if it would be a good investment at this point or not. And as always, we use a discount cash flow calculation to determine an intrinsic value.

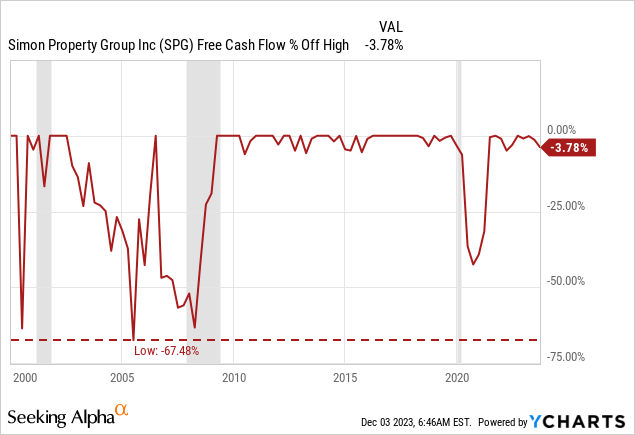

As basis for our calculation, we can use the free cash flow of the last four quarters, which was 3,027 million and seems to be in line with the average of the last few years. Especially as free cash flow was rather stable in the last few years (excluding the COVID-19 crash), we can be quite confident the current free cash flow is a reasonable assumption to use in our calculation. When calculating with 375 million shares outstanding and 10% discount rate, Simon Property Group must grow its free cash flow slightly above 3% from now till perpetuity in order to be fairly valued.

Our first impulse probably is that Simon Property Group will easily manage to grow between 3% and 4% annually as it is not a high growth rate. However, as pointed out above, Simon Property Group grew its earnings per share only with a CAGR of 3.28% in the last ten years and in the last five years only with a CAGR of 0.88%.

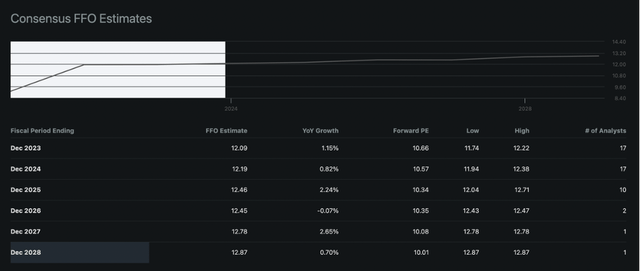

Additionally, analysts are also very cautious for the next few years and basically see no growth at all. Until fiscal 2028, analysts are expecting earnings per share to grow only with a CAGR of 1%.

Simon Property Group Consensus FFO Estimates (Seeking Alpha)

And of course, we should not ignore what I wrote above – the risk of a recession. When looking at free cash flow since 2000 (by the way, I am excluding the data before 2000 as free cash flow declined extremely steep – about 1,000% - and this would mess up the chart).

Conclusion

Combining these aspects, a potential recession on the horizon, Simon Property Group already having trouble to grow with a high pace in the last few years and analysts also being cautious, we could make the case that Simon Property Group seems fairly valued at this point. And although I was bullish in my last article when Simon Property Group was trading more or less for the same price, I would switch my rating to “Hold” again.